Bowtie Data Glossary

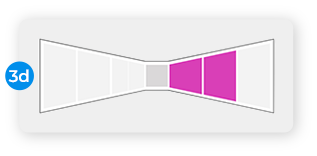

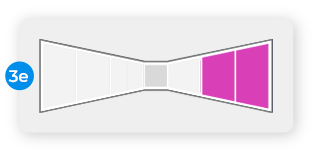

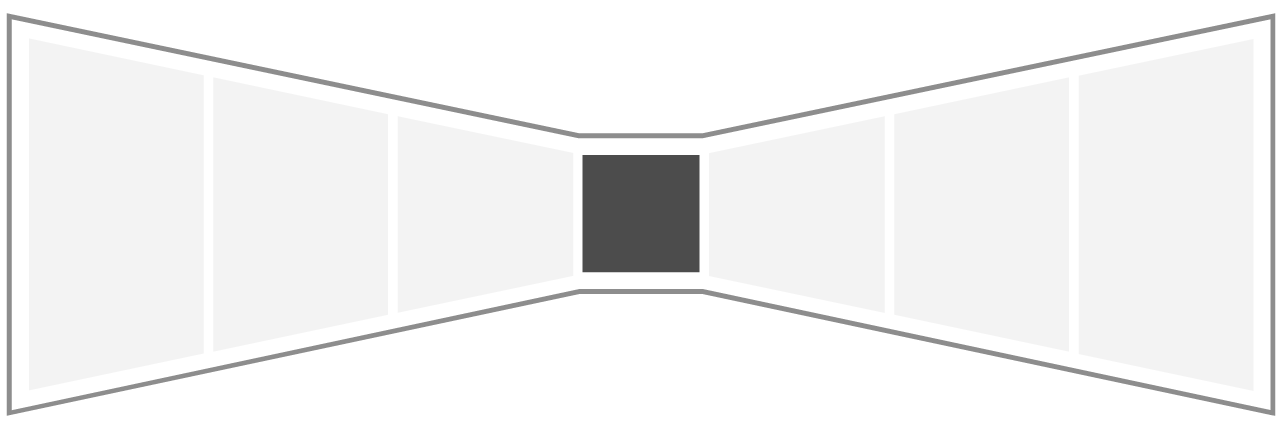

Recurring Revenue Operating Model

SALES CYCLE (months)

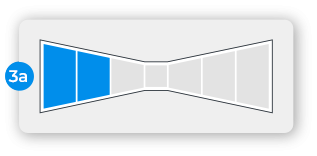

All data should reflect results from the designated segment and period, referred to herein as the "cohort".

Average New Deal Size

Average ARR (Annual Recurring Revenue) - after discounts - for deals from new accounts coming into the funnel for the Segment, during the period, excluding implementation and other non-recurring fees.

Average Discount %

Average discount as a percentage of list prices.

# of Leads Added to Funnel in Period

Number of leads generated for the Segment during the Period specified. These leads form a "cohort".

Lead-to-Opportunity Rate %

Percentage of leads in the cohort which ultimately converted to Sales Qualified Leads (also known as Pipeline Opportunity or Deal). Note that LTO is the product of CR1 and CR2.

CR1- Prospect to MQL Conversion Rate %

Percentage of leads in the cohort that became MQL (Marketing Qualified Leads).

MQL (Marketing Qualified Lead):

A person or unique organization (also referred to as “Marketing Qualified Account”) that expresses interest through their behavior and fits the target profile according to Marketing.

CR2- MQL to SQL Conversion Rate %

Percentage of MQLs in the cohort that ultimately became SQLs

SQL (Sales Qualified Lead)

A person or unique organization that acknowledges a pain addressed by the solution, fits the target profile, and indicates they desire to take action and engage with Sales.

Opportunity to Close %

Percentage of SQLs in the cohort that ultimately converted to closed-won deals. Note that OTC is the product of CR3 and CR4.

CR3- Qualification/Handoff %

Percentage of SQLs in the cohort that became SALs (Sales Accepted Leads).

SAL (Sales Accepted Lead)

A person or unique organization that has been accepted into the qualified opportunity or deal pipeline by the Sales Team, given that a Critical Event has happened and they're willing to take action now.

CR4- Win Rate %

Percentage of SALs in the cohort that became closed-won opportunities.

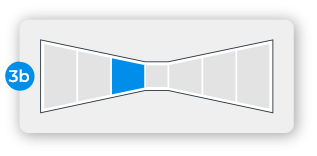

Avg. Sales Cycle

Average number of days or months between the date of SAL creation and the date of Closed Won for deals in the cohort.

CR5- Retention at Onboarding %

Percentage of closed won opportunities in the cohort that were successfully onboarded.

CR6- Renewal Rate %

Percentage of ARR (recurring revenue) retained (or expected to be retained) as of the end of Year 1, following go live-onboarding, across the cohort.

For example, if a cohort generated $1M of ARR post-onboarding (post-CR5), and $100k of ARR was churned/contracted during the first year, then CR6 would be 90% ($900k ÷ $1M)

CR7- Net Expansion %

New ARR added to the cohort, through upsells or expansions, during the course of the first year, measured as a percentage of ARR of the cohort, post-churn.

Using the example above, under CR6 – if that cohort added $300k of ARR through upsells and expansions, CR7 would be 33% ($300k ÷ $900k).

Net Revenue Retention %

NRR is an alternative measure of expansion (users may choose to enter NRR or CR7, but not both). NRR measures the net effect of CR6 and CR7 together, taking into account both the gross churn (ARR lost) and expansions and upsells during the first year.

Using the example above, the cohort started with $1M in onboarded deals, then during the first year, lost $100k through gross churn, and gained $300k through upsells & expansions, ending the year with $1.2M in ARR. Therefore, NRR would be 120% ($1.2M ÷ $1M).

Average New Deal Size

Average ARR (Annual Recurring Revenue) - after discounts - for deals from new accounts coming into the funnel for the Segment, during the period, excluding implementation and other non-recurring fees. In the event you have a few very large deals that would improperly skew the average, then use the median value instead.

Lead-to-Opportunity Rate %

Percentage of leads in the cohort which ultimately converted to Sales Qualified Leads (also known as Pipeline Opportunity or Deal). Note that LTO is the product of CR1 and CR2.

Typical LTO ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 1% | 2% | 3% | 5% | 8% | NA |

CR1- Prospect to MQL Conversion Rate %

Percentage of leads in the cohort that became MQL (Marketing Qualified Leads).

MQL (Marketing Qualified Lead)

A person or unique organization (also referred to as “Marketing Qualified Account”) that expresses interest through their behavior and fits the target profile according to Marketing.

Typical CR1 ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 5% | 10% | 15% | 20% | 30% | NA |

CR2- MQL to SQL Conversion Rate %

Percentage of MQLs in the cohort that ultimately became SQLs

SQL (Sales Qualified Lead)

A person or unique organization that acknowledges a pain addressed by the solution, fits the target profile, and indicates they desire to take action and engage with Sales.

Typical CR2 ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 15% | 20% | 20% | 25% | 25% | NA |

CR3- Qualification/Handoff %

Percentage of SQLs in the cohort that became SALs (Sales Accepted Leads).

SAL (Sales Accepted Lead)

A person or unique organization that has been accepted into the qualified opportunity or deal pipeline by the Sales Team, given that a Critical Event has happened and they're willing to take action now.

Typical CR3 ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 80% | 85% | 90% | 95% | 95% | 100% |

Avg. Sales Cycle

Average number of days or months between the date of SAL creation and the date of Closed Won for deals in the cohort.

Typical Sales Cycle range pre-2023 (in days):

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| <10 | 10 to 20 | 30 to 60 | 60 to 90 | 90 to 180 | 180+ |

CR7- Renewal Rate %

Percentage of ARR (recurring revenue) retained (or expected to be retained) as of the end of Year 1, following go live-onboarding, across the cohort.

For example, if a cohort generated $1M of ARR post-onboarding (post-CR6), and $100k of ARR was churned/contracted during the first year, then CR7 would be 90% ($900k ÷ $1M)

Typical CR7 ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 80% | 83% | 87% | 90% | 92% | 95% |

CR8- Net Expansion %

New ARR added to the cohort, through upsells or expansions, during the course of the first year, measured as a percentage of ARR of the cohort, post-churn.

Using the example above, under CR7 – if that cohort added $300k of ARR through upsells and expansions, CR8 would be 33% ($300k ÷ $900k).

Typical CR8 ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 10% | 15% | 20% | 22% | 25% | 30% |

Net Revenue Retention %

NRR is an alternative measure of expansion (users may choose to enter NRR or CR8, but not both). NRR measures the net effect of CR7 and CR8 together, taking into account both the gross churn (ARR lost) and expansions and upsells during the first year.

Using the example above, the cohort started with $1M in onboarded deals, then during the first year, lost $100k through gross churn, and gained $300k through upsells & expansions, ending the year with $1.2M in ARR. Therefore, NRR would be 120% ($1.2M ÷ $1M).

Typical NRR ranges pre-2023:

| Avg. Annual Contract Value | |||||

|---|---|---|---|---|---|

| <$1k | $1k-$5k | $5k-$15k | $15k-$50k | $50k-$150k | $150k+ |

| 88% | 95% | 104% | 110 | 115% | 124% |