Benchmarking

re-defined

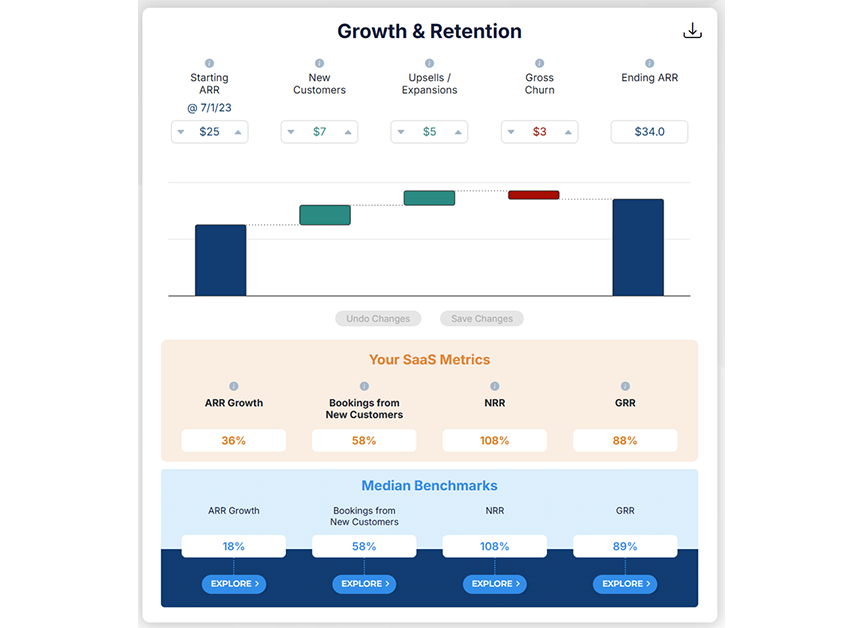

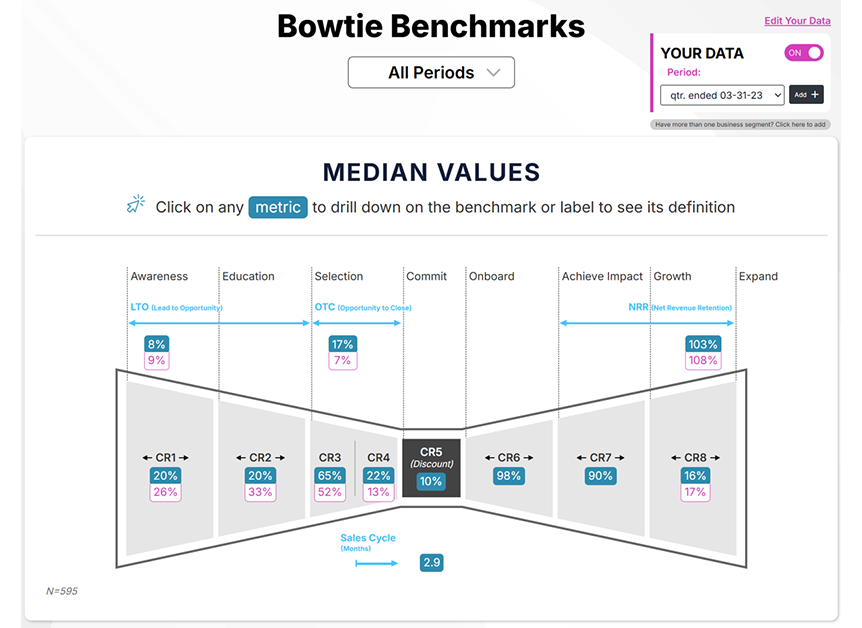

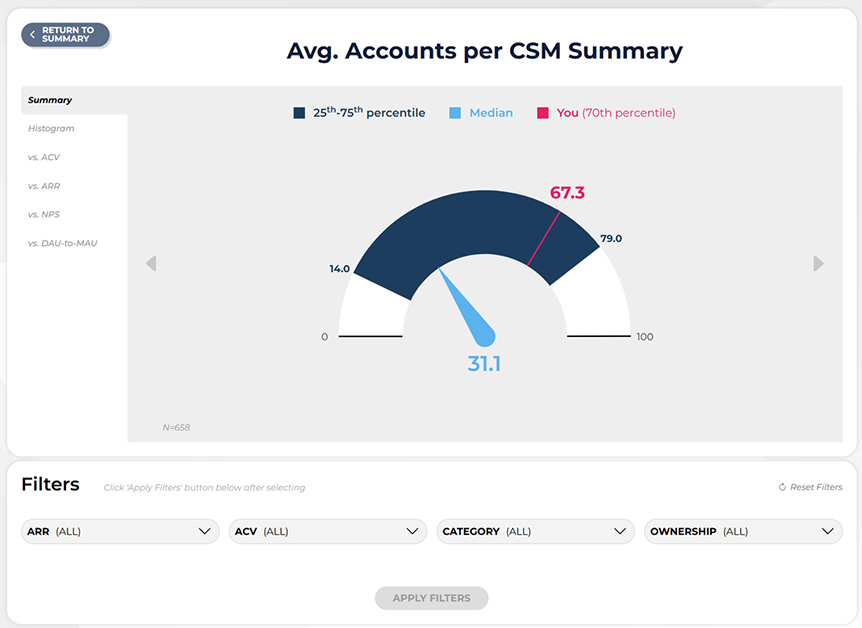

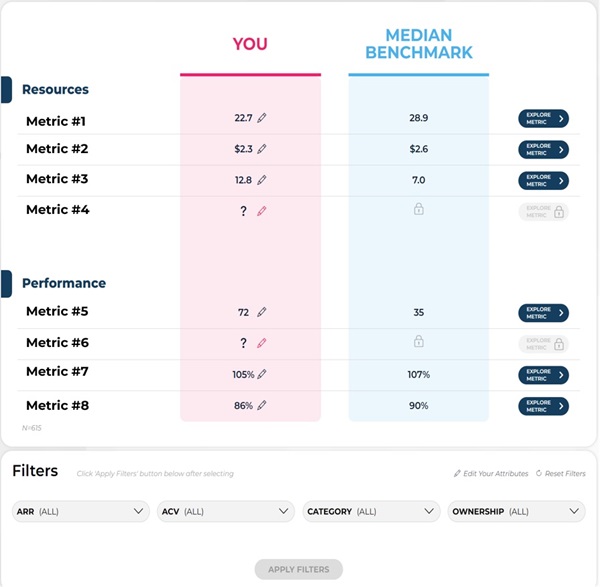

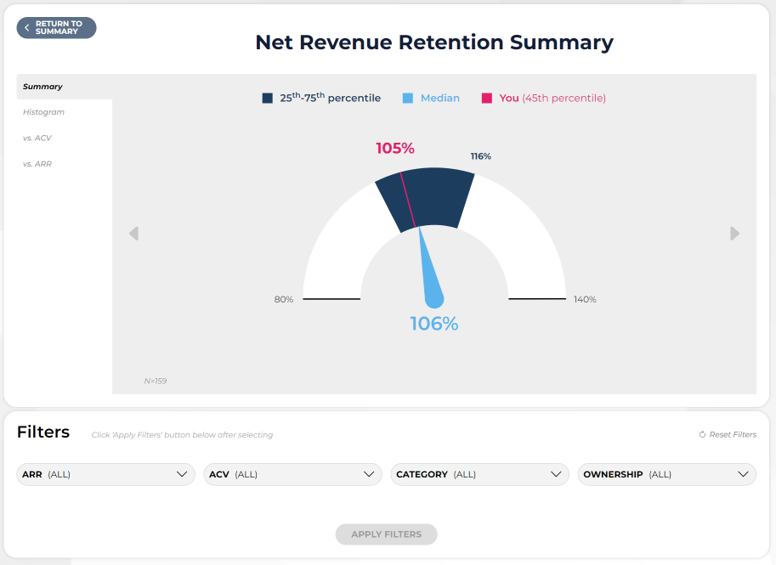

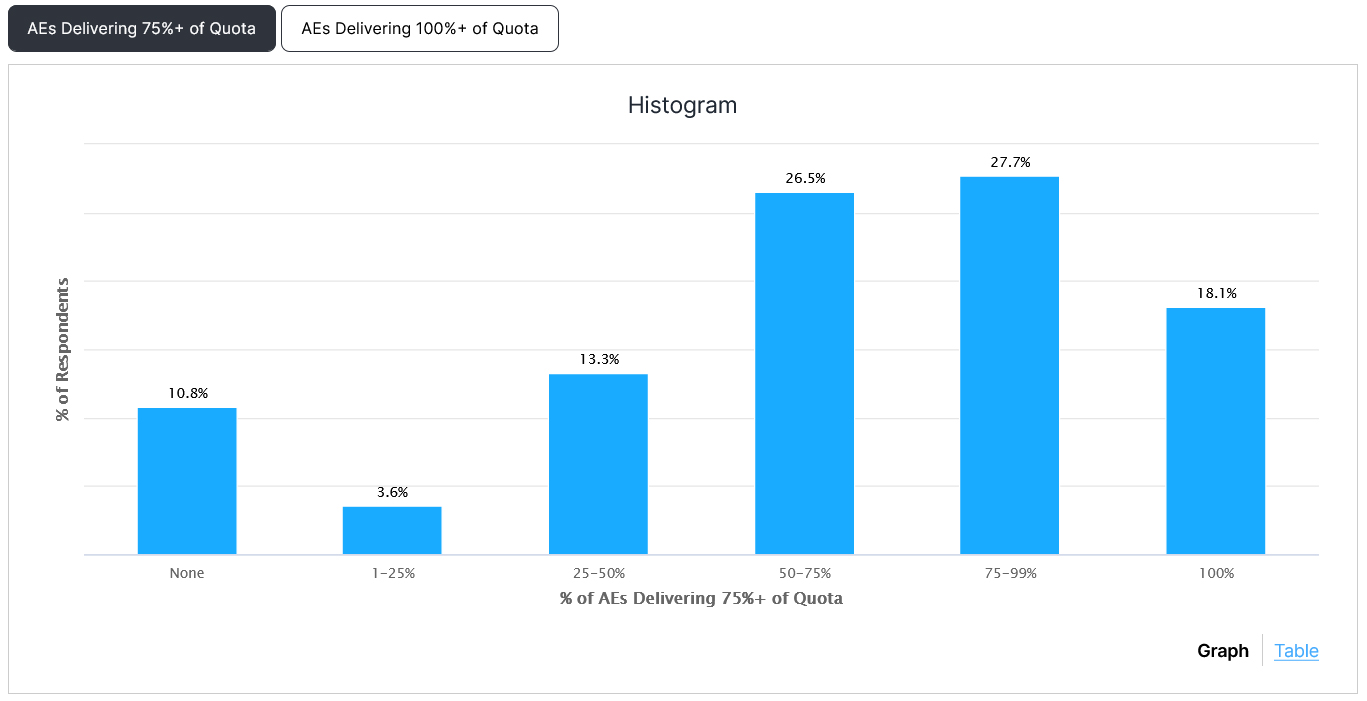

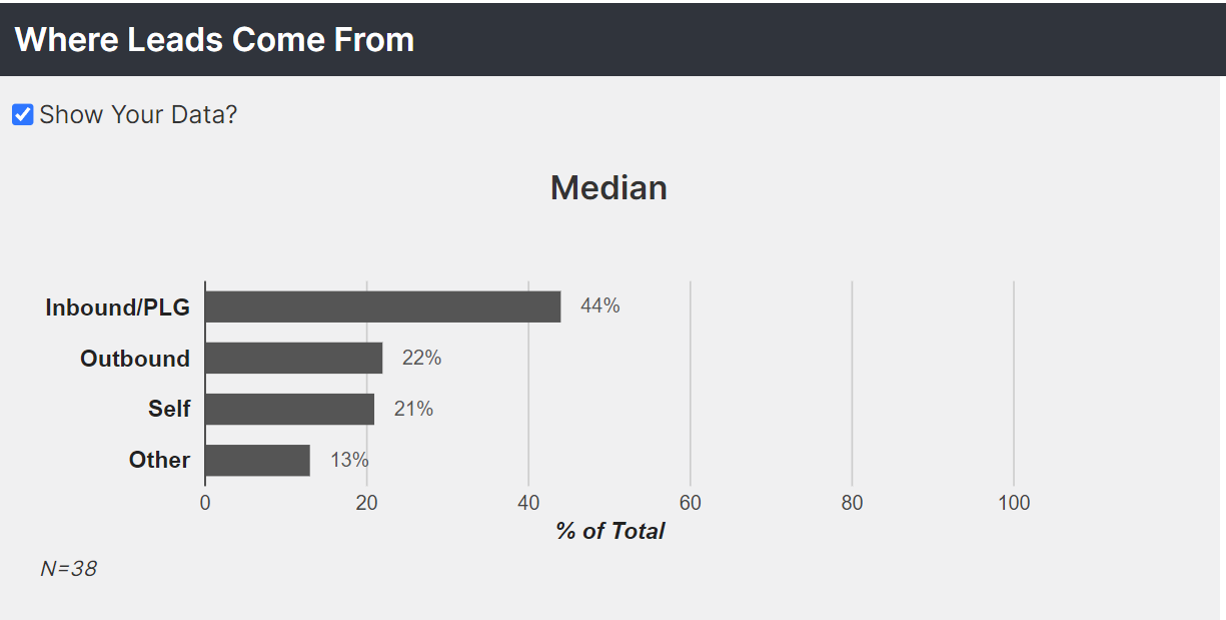

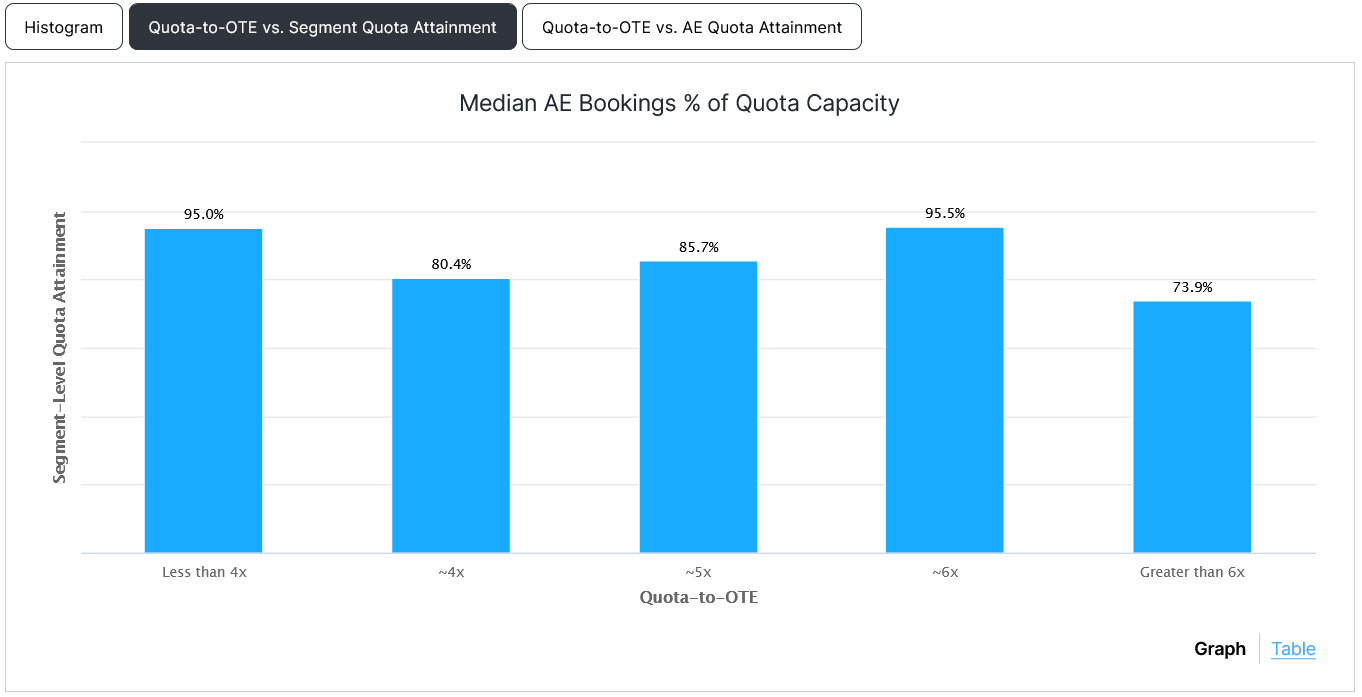

- Engaging App Experience (NOT a survey!)

- Get the benchmarks immediately

- Set filters to compare vs. your comps

- Always-on access to the benchmarks over time

- Built-in anonymization engine

White-Label Our Platform

- Benchmarking apps for your customers & prospects

- Powered by operational data you already have

- Show your customers how they rank

- Deploy it in the wild to build pipeline

Industry Trusted

Trusted by a wide variety of partners and active investors in the SaaS ecosystem.

Built from Years of Experience in SaaS

David Spitz, Founder & CEO of BenchSights

David brings over 30 years of software investment banking expertise to BenchSights, having previously led the Software practice at KeyBanc Capital Markets (formerly Pacific Crest Securities). His transaction leadership spans the SaaS industry’s most influential companies, including Salesforce, ServiceNow, Workday, Veeva, HubSpot, Twilio, Zoom, and dozens of other market leaders.

Beyond transactions, David has been a SaaS industry pioneer since its earliest days. In 2006, he established the investment banking sector’s first SaaS-focused conferences, and in 2010, created the industry’s first annual SaaS benchmarking reports—laying the groundwork for his future vision.

In 2021, David founded BenchSights to revolutionize how companies approach benchmarking through purpose-built software and data solutions. The company serves clients like Gainsight and Winning by Design, and recently launched its flagship SaaS Metrics application in 2025.

David holds three degrees from MIT: a BS in Computer Science, an MS in Operations Research, and an MBA from Sloan.